ESG considerations have always formed an integral part of Mediterrania Capital Partners’ investment process and portfolio management, supporting and driving sustainable thinking and practices in the industry.

Our investments seek to maximise gains for investors and stakeholders while supporting the economic and social development of African communities through job creation and improvement of work conditions, advanced education programmes and women empowerment.

The tight combination of financial aspects and ESG factors is a must as creating robust and sustainable frameworks helps building more resilient and valuable companies.

Our approach to Responsible Investing is available for download here.

Operating Principles for Impact Management

> Annual Disclosure Statement (October 2024)

> Independent Assurance Report (March 2024)

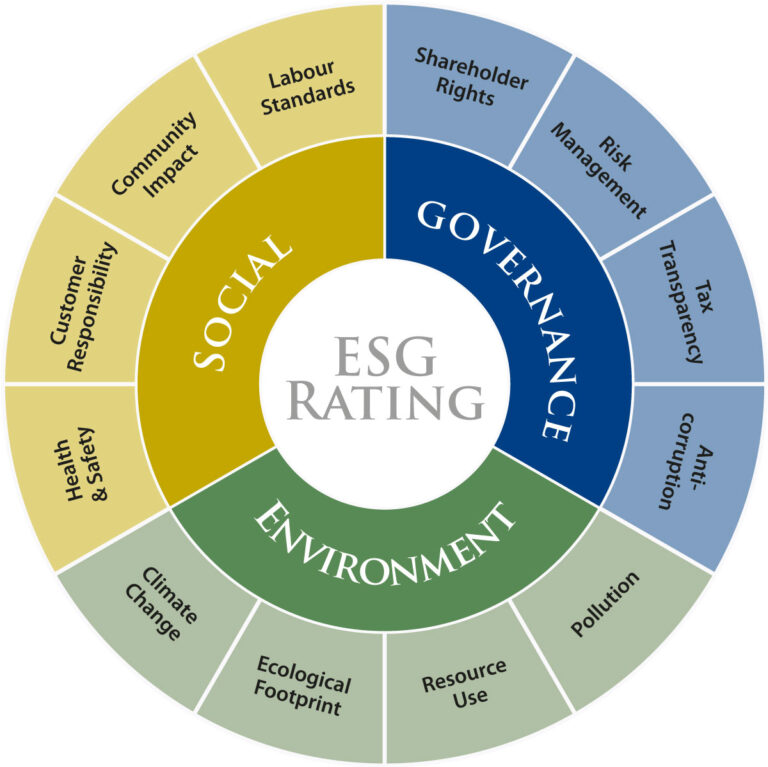

Recognising the increasingly critical importance of transparent, accurate and comparable ESG data and analytics, we have developed a proprietary scoring methodology that leverages the IFC Performance Standards and a common framework built around the three ESG pillars.

This new methodology helps us to measure in a transparent and objective manner the sustainability and ethical impacts of a company’s relative ESG performance, commitment and effectiveness.

At Mediterrania Capital Partners, we promote gender equality through conscientious approaches from pre-investment activities through to post-deal monitoring, and we invest with the aim of addressing gender issues in companies that promote workplace equality in staffing, management, boardroom representation, etc. and in companies that offer products or services that substantially improve the lives of women and girls.

Through our funds we invest in companies that actively pursue the well-being of their employees, their customers and the wider community. Also, we prioritise sectors that play a crucial role in supporting the growth of the economies and the improvement of people’s quality of life such as construction, food manufacturing and distribution, healthcare, education and financial services for low-income population.

At Mediterrania Capital Partners we guide and support our partner companies in the definition and implementation of policies towards environmental conservation such as pollution prevention, waste management, energy and fuel efficiencies, water resource management, natural resources conservation and/or sustainable land use.